A community lending program is a financial initiative aimed at providing loans to individuals or businesses within a specific community or geographical area. These programs are typically offered by local organizations, credit unions, or community development financial institutions (CDFIs).

The goal is to promote access to credit for underserved populations, stimulate local economic growth, and empower community members to achieve their financial goals. Community lending programs often have more flexible eligibility criteria and offer lower interest rates compared to traditional lenders.In a recent conversation between realtor Clovis CA Linda Peltz and Leigh Fisher from RWM Home Loan, an exciting program was unveiled that promises substantial savings for potential homebuyers. Let’s delve into the details of this program that could redefine how individuals approach the purchase or refinance of their homes.

Understanding the RWM Community Lending Program

A New Paradigm in Home Financing

Leigh Fisher, a seasoned professional with RWM Home Loan, introduced the Community Lending Program as a groundbreaking initiative. Unlike conventional programs, this one offers homebuyers significant advantages based on the property’s location.

The key features include discounted interest rates, lender credits to offset closing costs, or a compelling combination of both. It’s a game-changer, allowing buyers to secure more favorable financing terms, contributing to overall affordability.

Read More:

Unlocking Homeownership: A Deep Dive into RWM’s Community Lending Program with Leigh Fisher

Homeownership Dreams with RWM Home Loan’s Program – Leigh Fisher

How Does Insurance Work for Beginners; Insights from Scott Harris & Linda Peltz Realtor

The Geographical Advantage

The uniqueness of the program lies in its geographical component. Fisher pointed out that specific areas within Fresno and Madera qualify for these benefits. Utilizing a heat map, she showcased how a considerable portion of Fresno, and potentially parts of Clovis, fall within the eligible zone. The prospect of savings on the interest rate, sometimes up to half a percentage point, presents an enticing proposition for prospective homeowners.

Not Just for First-Time Buyers

A refreshing aspect of the Community Lending Program is its inclusivity. Unlike many assistance programs, there are no income restrictions. Fisher emphasized that the primary criteria revolve around credit scores, requiring a minimum of 620 for conventional loans.

The program’s standout feature lies in its ability to issue certified pre-approvals rapidly, streamlining the homebuying process and empowering buyers with a competitive advantage in the market. The comprehensive support offered by this program extends to multi-unit properties, eliminating limitations and simplifying the path to homeownership. Ultimately, this program is not just about securing a home; it is a transformative experience, making homeownership a tangible and financially rewarding reality for a diverse range of buyers.

Conversation Highlights

- Program Overview and Eligibility

– Linda introduces the property and hands the floor to Leigh to delve into the RWM Community Lending Program.

– Leigh explains the program’s exclusivity for specific areas, emphasizing potential savings for buyers in these locations.

– Eligibility criteria include a conventional loan, primary residence occupancy, and a credit score of 620 or above.

- Partnership Details

– Linda queries if it’s a government program, and Leigh clarifies RWM’s status as a correspondent lender with a unique partnership with a bank, offering this program as part of their Community Reinvestment Act commitments.

- Mapping Eligible Locations

– Leigh showcases a heat map of eligible areas in Fresno, hinting at savings up to half a percentage point on interest rates.

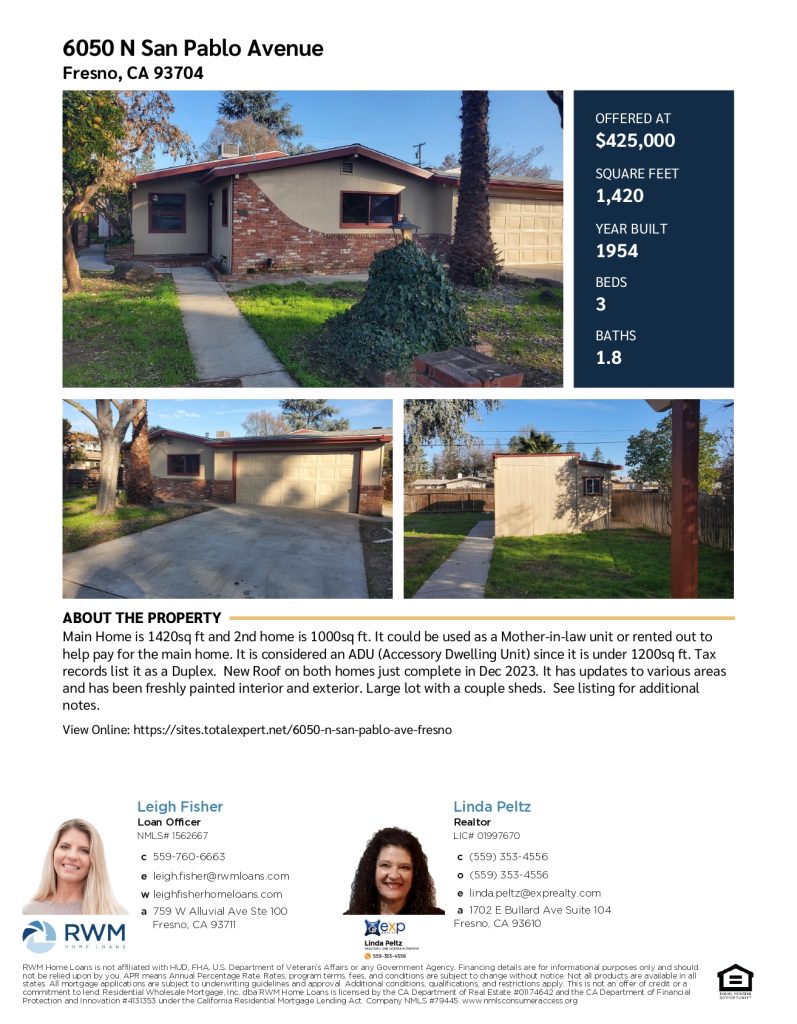

- Property with Two Units

– Linda brings up a property with two units, exploring if the program covers such cases. Leigh affirms the program’s flexibility, emphasizing the absence of income restrictions.

- Simplifying Pre-Approval

– Leigh discusses the pre-approval process, highlighting RWM’s certified pre-approval with underwriters involved, providing a 17-day offer advantage in the competitive market.

– Leigh shares RWM’s internal resources, mentioning $4.500 available for rate reductions or lender credits, enhancing the buyer’s position

To start your journey with RWM Home Loans’ Community Lending Program, contact Leigh Fisher and Linda Peltz Realtor Clovis CA in details below:

Leigh Fisher | NMLS# 1562667

RWM Home Loans

c 559-760-6663

e leigh.fisher@rwmloans.com

w leighfisherhomeloans.com

FOLLOW US; CLICK FOR YOUR FAVOURITE CHANNEL

https://linktr.ee/RealtorFresnoCA

Call me for further details:Linda Peltz, eXp Realty | DRE 01997670

c 559-353-4556

e LWPproperty@gmail.com

w https://Linda.Peltz@exprealty.com