Buying a home for the first time can be both an exciting and overwhelming experience. In today’s market, where interest rates and property prices are high, the process can seem even more daunting.

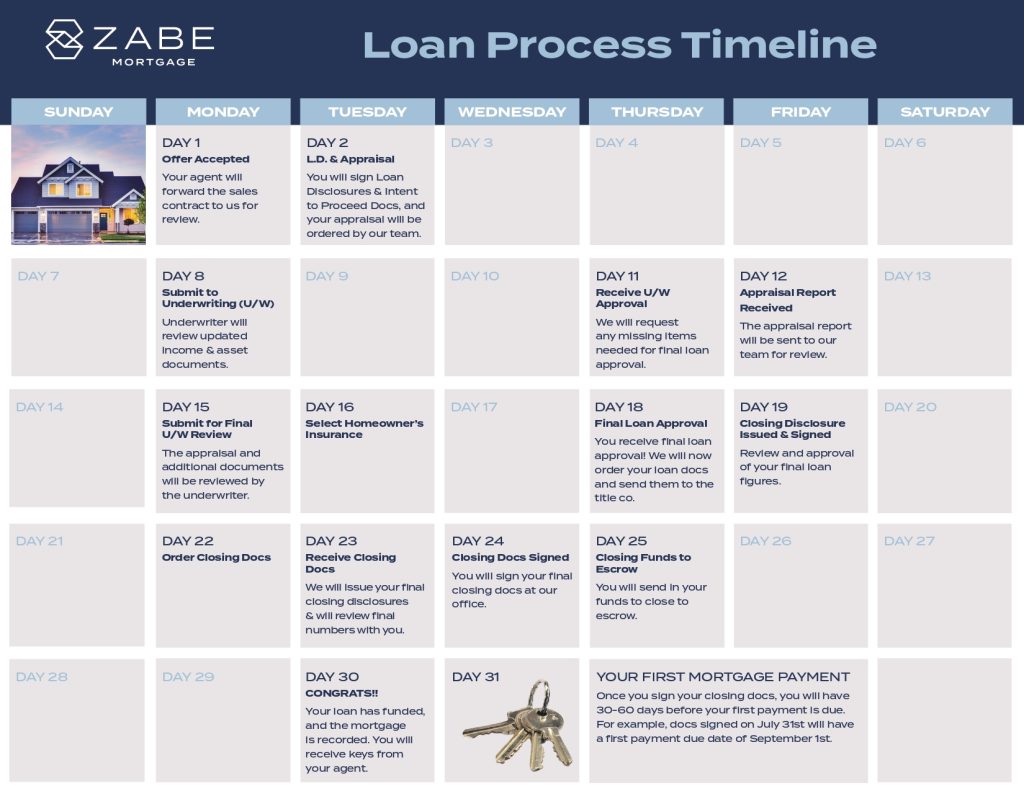

This insightful discussion will walk you through the lending process for first-time home buyers, focusing on the critical steps and how to navigate them successfully. Andrew Morales from Zabe Mortgage provides insights into how their client-focused approach can make all the difference.

Tune in for more insight

Understanding the Initial Lending Steps

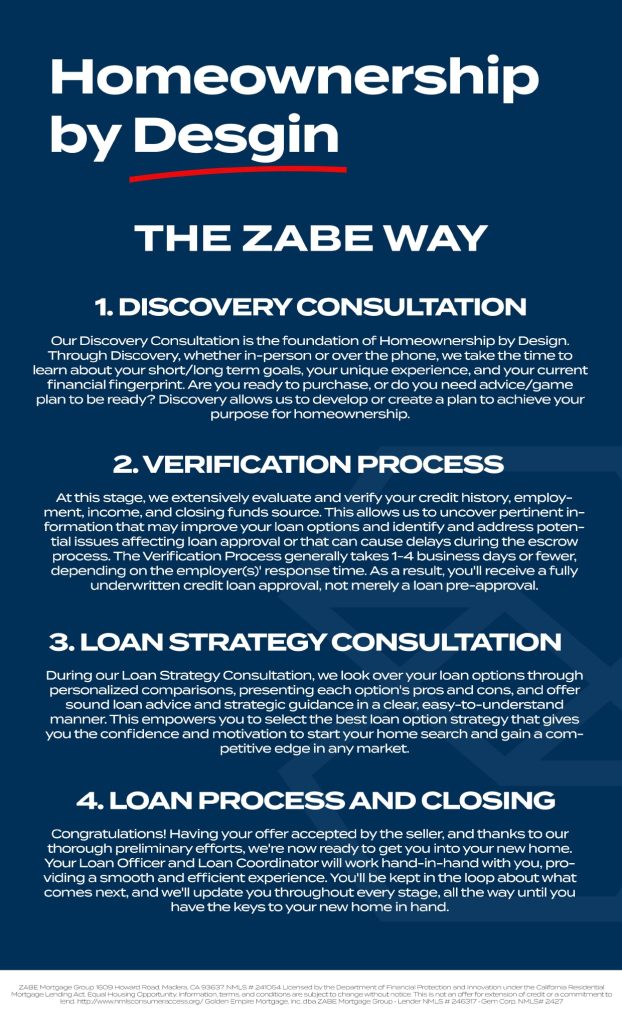

The first step in the lending process is the Discovery Consultation. This is where the lender gets to know the potential buyer and their goals. Andrew Morales emphasizes the importance of this step, as it helps to identify the buyer’s needs and concerns right from the start.

The consultation involves a thorough review of the buyer’s application, including their employment history and financial situation. It’s also a chance for the buyer to express what home ownership means to them, providing a clear picture of their motivation and long-term goals.

The Verification Process

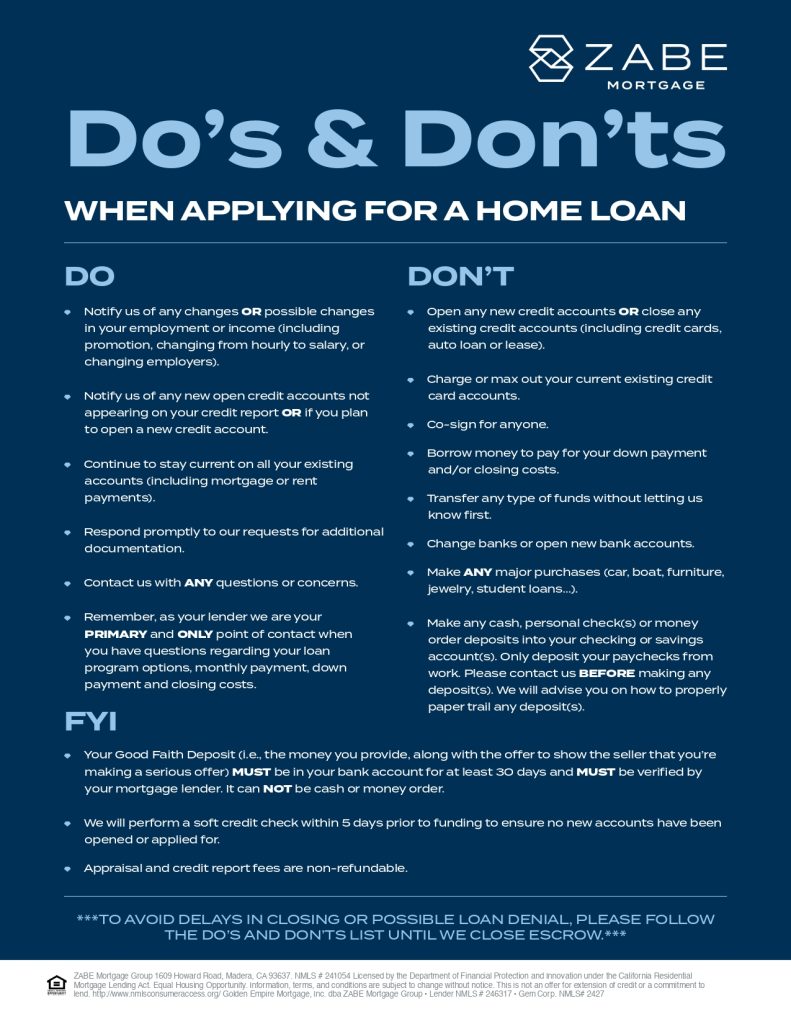

Following the initial consultation, the verification process begins. This is a crucial step where the lender verifies the buyer’s income, assets, and credit history. At Zabe Mortgage, they ensure all aspects of the buyer’s financial situation are thoroughly checked to avoid any surprises later in the process.

Andrew Morales notes that many lenders fall short in this area by not conducting a full verification, leading to potential issues down the line. This thorough verification helps in creating a robust and accurate pre-approval for the buyer.

Read More:

Embracing AI Automation in Business Operations with Leena Mendoza and Linda Peltz

Clines Business Equipment Inc, Tailored Solutions for Every Office Needs in California

Loan Strategy Consultation

Once the verification is complete, the next step is the Loan Strategy Consultation. This is where the lender and buyer sit down to discuss the best loan options available. Morales explains that this consultation is about more than just finding the lowest interest rate; it’s about developing a strategy that aligns with the buyer’s financial situation and goals.

During this stage, different loan programs are presented, and their pros and cons are explained in detail. This ensures the buyer fully understands their options and can make an informed decision.

Get Free Quote with Zabe Mortgage

Navigating the lending process as a first-time home buyer can be complex, but with the right guidance, it becomes manageable. By focusing on thorough initial consultations, meticulous verification processes, and strategic loan consultations.

Zabe Mortgage ensures their clients are well-prepared and confident in their home-buying journey. If you’re a first-time home buyer looking for a lender who prioritizes your needs and goals, consider Zabe Mortgage. Their team will work closely with you to develop a tailored plan, ensuring a smooth and successful home buying experience.

Zabe Mortgage

559-908-9708

andrewm@zabemortgage.com

www.drewdoesloans.com

Ivan Leon, eXp Realty | DRE 02240327

559-513-4373

ivan.leon.ca@exprealty.com

FOLLOW US; CLICK FOR YOUR FAVOURITE CHANNEL

https://linktr.ee/RealtorFresnoCA

Call me for further details:

Linda Peltz, eXp Realty | DRE 01997670

559-353-4556

lwpproperty@gmail.com